Life Insurance in and around Appleton

Protection for those you care about

What are you waiting for?

Would you like to create a personalized life quote?

- Outagamie County

- Appleton, WI

- Greenville

- Hortonville

- Wisconsin

- Neenah

- Menasha

- Kaukauna

- Little Chute

- Combined Locks

- Kimberly

- Black Creek

- Grand Chute

- Fox Cities

- Fox River

- Appleton

- Winnebago County

- Calumet County

- Seymour

- Shiocton

- Wolf River

- New London

- Clayton

- Fox Crossings

State Farm Offers Life Insurance Options, Too

There's a common misconception that Life insurance isn't necessary when you're still young, but even if you are young and just rented your first place, now could be the right time to start learning about Life insurance.

Protection for those you care about

What are you waiting for?

Agent Matt Holtebeck, At Your Service

Coverage from State Farm helps you rest easy knowing your loved ones will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the many expenses that come with providing for children, life insurance is a vital need for young families. Even if you or your partner do not have an income, the costs of filling the void of housekeeping or before and after school care can be a great burden. For those who don't have children, you may have a partner who is unable to work or have debts that are cosigned.

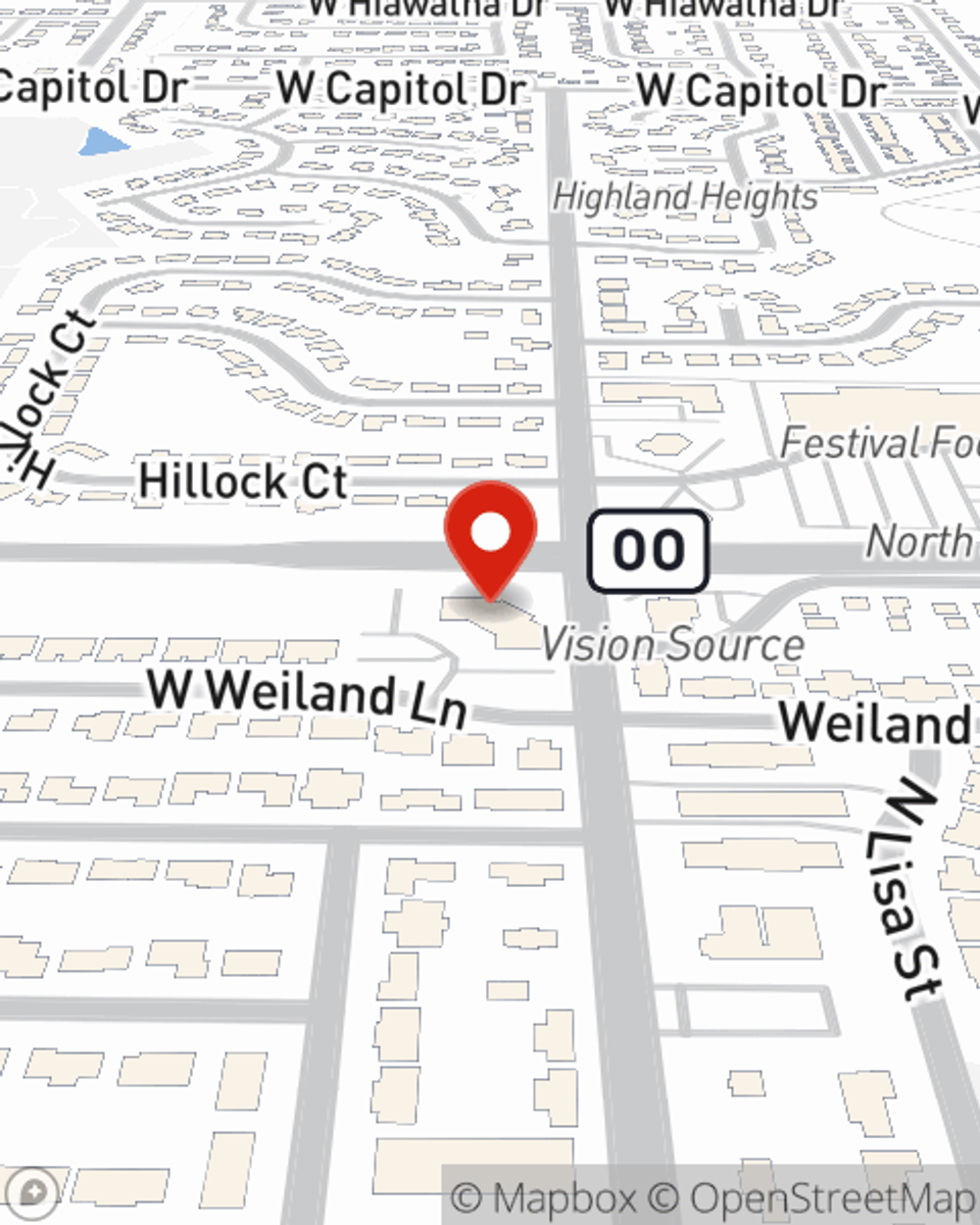

As a trustworthy provider of life insurance in Appleton, WI, State Farm is committed to protect those you love most. Call State Farm agent Matt Holtebeck today and see how you can save.

Have More Questions About Life Insurance?

Call Matt at (920) 739-3003 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Matt Holtebeck

State Farm® Insurance AgentSimple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.